IRS Installment Agreement

The IRS is dedicated to collecting all of the income taxes that are due. Congress has given the IRS permission and authority to collect income taxes by any means necessary. This means that the IRS can possibly put a lien on your retirement and bank accounts, seize your home and garnish your wages to collect their money. These are the extremes the IRS will come to, however, this usually occurs when the taxpayer cannot pay what they owe all at once. If this is a situation you as the taxpayer find yourself in, there are different methods to compromise with the IRS, an IRS Installment Agreement being one of them.

A tax advisor can work out an installment agreement with the IRS on the tax payer’s behalf to make smaller and more manageable payments that the individual can afford. The tax attorney involved is essentially bargaining with the IRS on behalf of the taxpayer. Both parties must be satisfied with the deal made. The taxpayer needs to be able to afford the payments and make them on time while still being financially stable to support themselves and family. On the other hand the IRS wants to collect their funds from the individual as fast as possible. The tax advisor must have adequate negotiating skills to satisfy both parties.

If you find yourself in the position of not being able to afford to pay your taxes, please consider an IRS Installment Agreement with your tax professional. This can add not only peace of mind to your difficult situation but also a light to the end of a long financial tunnel. Contact Us Today to schedule a FREE consultation.

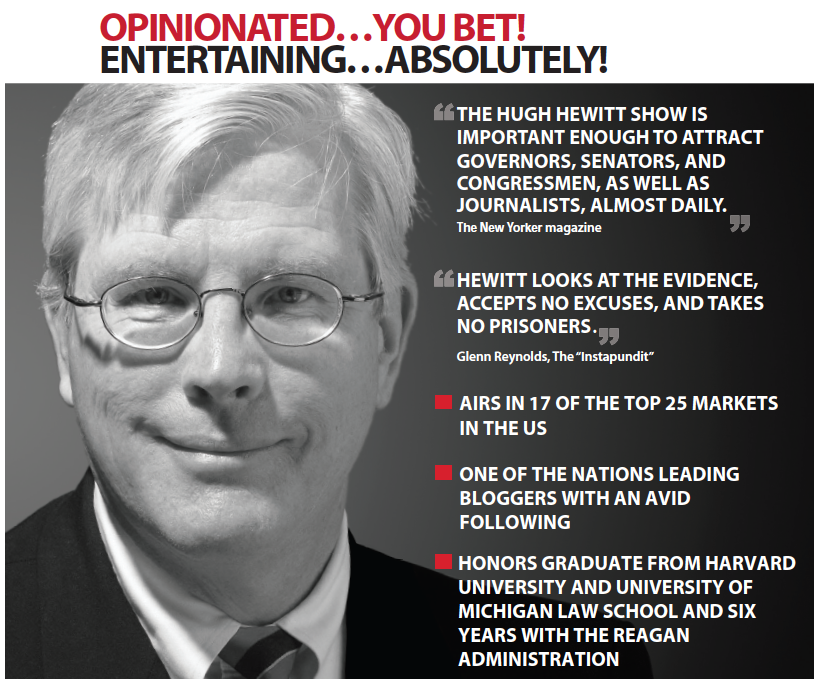

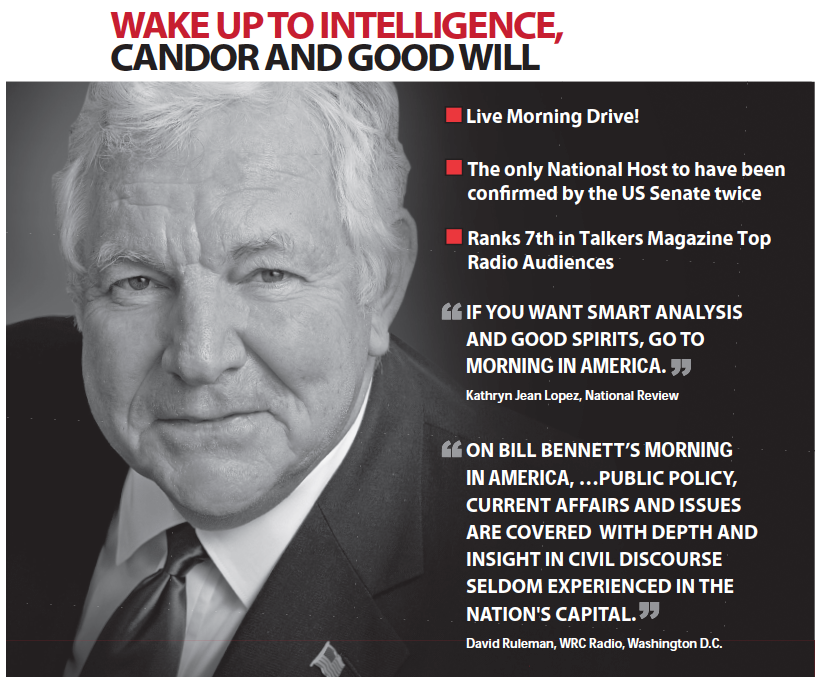

As Heard On

Will YOU Be Our Next Success Story?

Rapid Resolution Tax Group has achieved outstanding results for our clients because we only focus on solving IRS tax problems. Don't take our word for you, click to view some of our client's acceptance letters from the IRS.

Click To ViewWe Solve Your Tax Problems

Who Are We?

We Provide Tax Relief to All 50 States

When you work with our team, you trust your situation to former IRS Tax Attorneys, CPAs, and Tax Professionals. Our goal is to help you keep what’s yours, recover your funds, and protect your future. Have no fear, for we are passionate about helping you win!

When you work with our team, you trust your situation to former IRS Tax Attorneys, CPAs, and Tax Professionals. Our goal is to help you keep what’s yours, recover your funds, and protect your future. Have no fear, for we are passionate about helping you win!

Ready to get your tax problems under control?

Contact us now for a FREE consultation!

Contact Us

"The only tax resolution company that I recommend to friends and listeners!"

"The only tax resolution company that I recommend to friends and listeners!"