When Should I Call a Tax Attorney?

Dealing with the IRS can be complicated and frustrating, but knowing when to contact a tax attorney for assistance is not. When it comes to addressing the IRS, time is of most importance.

As professional tax attorneys, we’ve worked with hundreds of clients to resolve their tax debt problems and restore their name with the […]

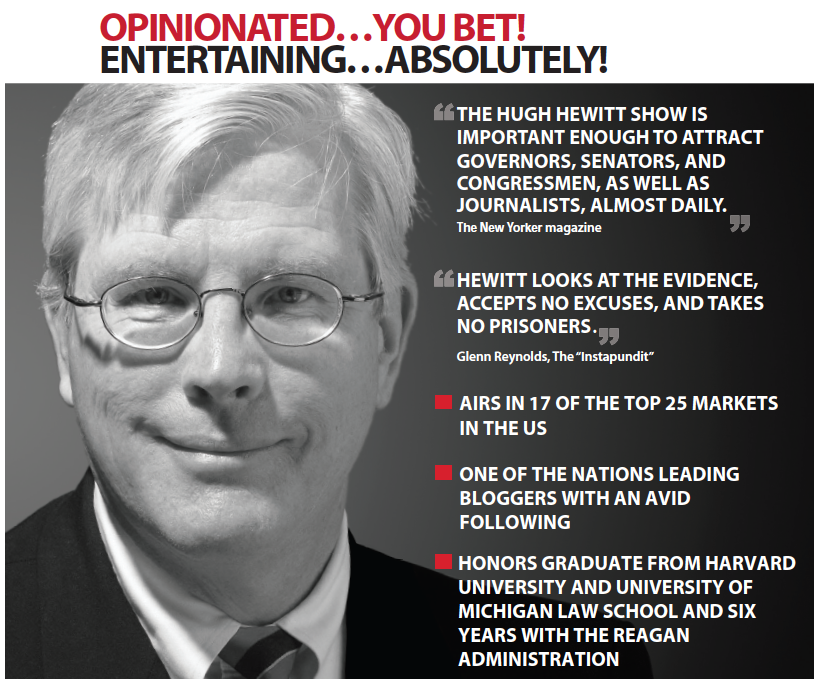

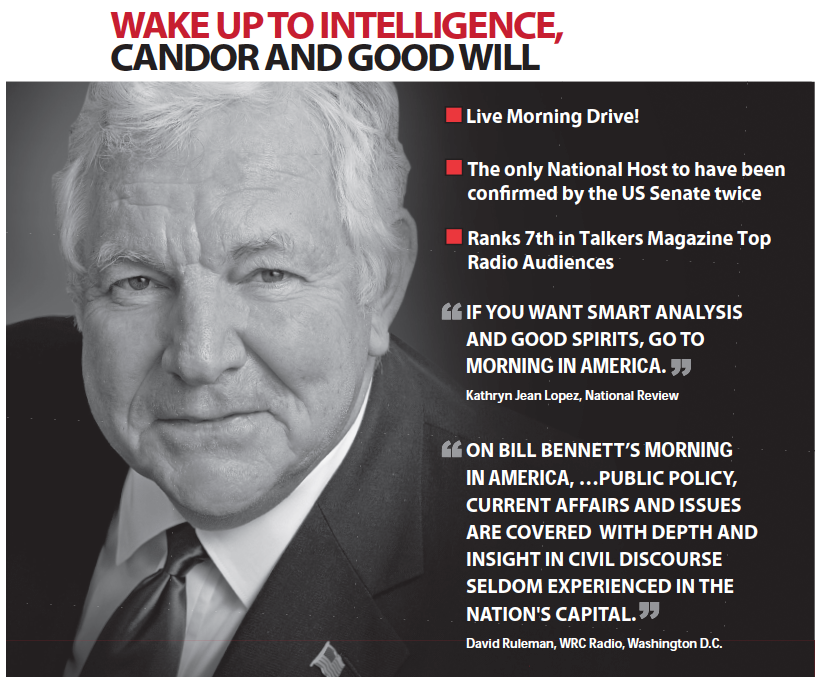

"The only tax resolution company that I recommend to friends and listeners!"

"The only tax resolution company that I recommend to friends and listeners!"